ASBIS Group in Q1 2015: lower market demand and one-off events negatively affected margins and led to a loss.

Limassol, Cyprus, May 7th, 2015 – ASBISc Enterprises Plc, a leading distributor of IT products in the emerging markets of Europe, the Middle East and Africa, has announced its results for Q1 2015.

Revenues decreased by 17.69% to USD 281.8m, from USD 342.4m in Q1 2014, mostly due to lower market demand in many geographies and strong competition on the own brands business. Gross profit decreased to USD 6.9m, from USD 22.2m in Q1 2014, due to lower revenues and one-off events: clearing of inventories at lower prices and warranty losses.

The company continued to reduce its expenses, cutting admin, selling and financial costs by 29.64%, 12.60% and 37.59% respectively. This was not enough however to fully offset the decrease in gross profit. As a result, in Q1 2015 the company generated a net loss after taxation of USD 12.4m, in comparison to a net loss after taxation of USD 3.4m in Q1 2014.

Although continuation of unfavourable market conditions in the Former Soviet Union is expected for the rest of this year, the company observes improvement in other regions, and expects revenues and gross profit to start growing from Q2 2015 and the overall results to further improve in the second half of the year, as was the case in 2014.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “We were prepared for a much better quarter in terms of sales. However, due to market weakness, a lot of customers postponed new orders while they were flushing out old stocks. This resulted in lower sales and a lower gross profit. Sales at lower prices also contributed to this decrease. Our results have been also affected by warranty losses.”

Kostevitch continued: “The inventory sell-out and warranty losses cost us about USD 7.1m. While we expect the F.S.U. market to remain weak this year, we have changed our inventory plans, taken actions to resolve warranty claims, and revised our credit risk policy. As a result, we do not expect all these factors that affected our Q1 2015 results to happen again in the future. Our revenues and gross profit margin are expected to start growing from Q2 2015, with significant improvement expected to be delivered in the second half of the year.”

FINANCIAL RESULTS IN Q1 2015 AND Q1 2014 (USD ’000)

|

Q1 2015 |

Q1 2014 |

Change Q1/Q1 |

|

|

Revenue |

281,809 |

342,390 |

-17.69% |

|

Gross profit |

6,886 |

22,236 |

–69.03% |

|

Gross profit margin |

2.44% |

6.49% |

–62.37% |

|

Administrative expenses |

5,555 |

7,895 |

–29.64% |

|

Selling expenses |

9,940 |

11,373 |

–12.60% |

|

Profit from operations |

(8,608) |

2,968 |

N/A |

|

EBITDA |

(7,980) |

3,747 |

N/A |

|

Profit after taxation |

(12,404) |

(3,387) |

N/A |

DETAILED INFORMATION ON SALES PROFILE

A country-by-country analysis confirms that a major decrease in sales was noted in the markets directly affected by the political crisis in Ukraine. Similarly to 2014, the decrease in Ukraine and Russia was the most dramatic. Revenues in the Czech Republic and Bulgaria decreased as well, due to lower sales of own brands and limited trading in third-party smartphones. The company’s revenues in other CEE countries grew, with the most significant improvement noted in Poland. Additionally, sales in Slovakia grew, based on a rich portfolio of products, to become the company’s no. 1 market in revenues in Q1 2015. The company also generated good results in Kazakhstan, thanks in particular to the iPhone business. Asbis expects this trend to continue, especially as this business may be expanded also in other CIS countries.

Top-selling countries by performance in Q1 2015 and Q1 2014 (USD ’000)

|

COUNTRY |

SALES PERFORMANCE |

||

|

|

Q1 2015 |

Q1 2014 |

Change % |

|

Kazakhstan |

32,852 |

12,016 |

+173.41% |

|

Poland |

29,400 |

17,000 |

+72.95% |

|

United Arab Emirates |

33,257 |

29,376 |

+13.21% |

|

Slovakia |

49,962 |

46,339 |

+7.82% |

|

Romania |

11,058 |

11,175 |

-1.05% |

|

Czech Republic |

11,786 |

19,845 |

-40.61% |

|

Russia |

33,569 |

73,381 |

-54.25% |

|

Belarus |

5,651 |

14,364 |

-60.66% |

|

Bulgaria |

6,617 |

19,353 |

-65.81% |

|

Ukraine |

6,799 |

21,980 |

-69.07% |

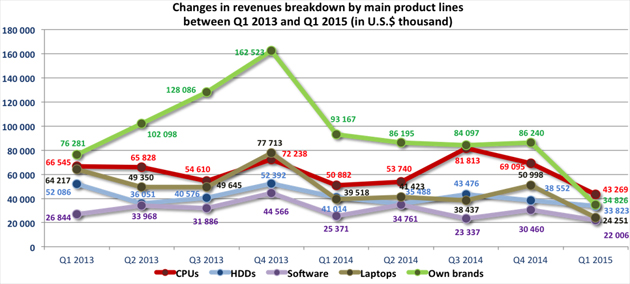

Since February 2014, the company’s revenues have been under serious pressure from the turbulence in Ukraine, which has affected a number of countries of operations. This did not change in Q1 2015, and adversely affected revenues from all product lines the group carries.

Revenues from own brand business decreased in Q1 2015 compared to Q1 2014 by 62.62%, and the share of own brand business in total revenues in Q1 2015 decreased to 12.36%, from 27.21% in Q1 2014. The share of the four traditional product lines (CPUs, HDDs, laptops and software) in total revenue remained at levels similar to 2014, at 43.77% in Q1 2015 compared to 45.79% in Q1 2014.

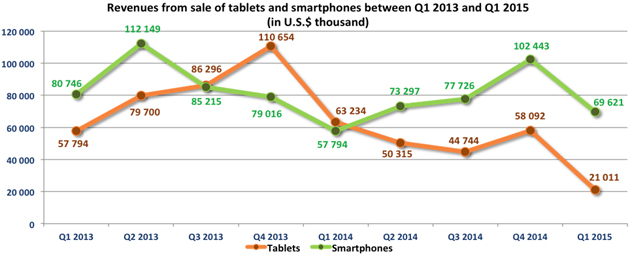

Revenues from smartphones grew significantly, by 34.11%, in Q1 2015, compared to Q1 2014. The company intends to further develop smartphone sales, both own brands and third-party. The increase in Q1 mostly related to iPhone distribution in Kazakhstan and other territories.

Revenues from tablets decreased by 66.77% in Q1 2015 compared to Q1 2014. This is connected with the smaller scale of business in Ukraine and Russia, as well as marginal growth noted in this market segment in other countries due to market saturation, stronger competition, and the company’s decision to focus on fewer models with better margins. Furthermore, a significant decrease of the average selling price (ASP) of tablets was noted.

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors, and manufactures and sells private-label products: Prestigio smartphones, tablet PCs, external storage, leather-coated USB accessories, GPS devices, Car-DVRs, MultiBoards etc. and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, more than 1,400 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com.