ASBIS in Q1 2011: Increase in Revenues, Profits on All Levels

Revenues grew by 5,63%, ebitda higher by 76% and gross profit margin increased by 19.08%, to 5.56%

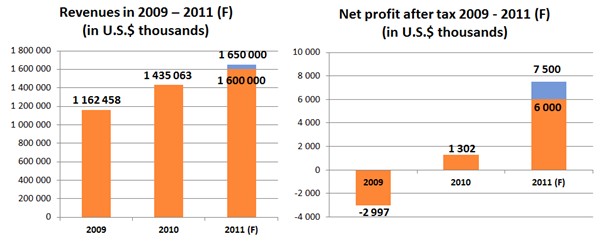

Limassol, Cyprus, May 11th, 2011 – ASBISc Enterprises Plc, a leading distributor of IT products in emerging markets of Europe, the Middle East and Africa, posted revenues of USD 349 million for the first quarter of 2011, 5.63% higher than in Q1 2010. In the same period, gross profit grew by 25.97% and the gross profit margin grew by 19.08%, to 5.56%, from 4.67% in Q1 2010. EBITDA grew by 76.29%, to USD 4.506 million, from USD 2.556 million in Q1 2010. This allowed ASBIS to generate a net profit of USD 829 K, over four times higher than reached last year, and sustain its forecast of USD 1.6 billion to 1.65 billion of revenues and USD 6 million to 7.5 million of net profit for the whole 2011.

“Having built our strategy for 2011, we placed our efforts on improvement of our internal efficiencies as well as upgrading our product portfolio, with the ultimate goal to increase gross profit margins and improve profitability on all levels,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “The effects of this were visible in Q1 2011, as we have seen increased results in both revenues and profitability. The revenue increase was driven primarily by a strong 20.39% increase in sales in Russia, while sales in other regions remained stable. We mainly emphasized improving margins and cash flow in Q1 2011. This was visible in our P&L, as the gross profit margin grew significantly, by 19.08%, from 4.67% to 5.56% in Q1 2011. This was possible because of a refined product portfolio and internal efforts to minimize external factors that affected us during the crisis times. With EBITDA growing by 76.29% and net profit by 310% y-o-y we are optimistic about the financial forecasts published earlier this year.”

For the whole 2011 ASBIS expects to reach from USD 1.60 billion to USD 1.65 billion of revenues and from USD 6.0 million to USD 7.5 million of net profit.

“In February this year, for the first time from the start of listing on Warsaw exchange, we have decided to publish financial forecasts,” Kostevitch said. “Therefore we prepared them with conservatism and due care. If the market trend that existed in Q1 2011 continues for the rest of the year, with normal seasonality, we expect to deliver the results.”

FINANCIAL RESULTS IN Q1 2011 AND Q1 2010

|

USD thousands |

Q1 2011 |

Q1 2010 |

Change |

|

Revenues |

349,619 |

330,995 |

+5.63% |

|

Gross profit after currency movements |

19,453 |

15,443 |

+25.97% |

|

Gross profit margin |

5.56% |

4.67% |

+19.08% |

|

Administrative expenses |

6,339 |

5,630 |

+12.59% |

|

Selling expenses |

9,363 |

7,978 |

+17.36% |

|

Operating profit |

3,752 |

1,835 |

+104.47% |

|

EBITDA |

4,506 |

2,556 |

+76.29% |

|

Net profit |

829 |

202 |

+310.40% |

FINANCIAL FORECASTS FOR 2011

DETAILED INFORMATION ON SALES PROFILE

Traditionally and throughout the Company’s operation, the region contributing the majority of revenues has been the Former Soviet Union. This changed temporarily in 2009, when the Central and Eastern Europe region was less affected by the world’s financial crisis. However, together with recovery of big markets like Russia and Ukraine, F.S.U. regained the first position in the Company’s structure of revenues in 2010. This was also the case in Q1 2011, when revenues derived from the F.S.U. region grew by 19.13% compared to the corresponding period of 2010, while sales in other regions remained relatively stable.

“Our biggest single market, Russia, grew by 20.39% and therefore covered a slower quarter of some other countries, like Slovakia,” Kostevitch said. “Apart from that, revenues grew also in many other countries, i.e. the Czech Republic by 14.17% and Belarus by 20.40%. Overall this allowed the Company to increase its revenues from sales by 5.63%. These numbers clearly show that our large geographical presence is a key to our success throughout the twenty years of our existence.”

REVENUE BREAKDOWN BY REGIONS IN Q1 2011 AND Q1 2010 (in USD thousands)

|

Region |

Q1 2011 |

Q1 2010 |

|

Former Soviet Union |

145,126 |

121,825 |

|

Central and Eastern Europe and Baltic States |

112,908 |

114,589 |

|

Middle East and Africa |

51,801 |

51,656 |

|

Western Europe |

29,589 |

30,255 |

|

Other |

10,195 |

12,671 |

|

Total |

349,619 |

330,995 |

REVENUE BREAKDOWN IN Q1 2011 AND Q1 2010 – TOP 10 COUNTRIES (in USD thousands)

|

|

Q1 2011 |

Q1 2010 |

||

|

|

Country |

Sales |

Country |

Sales |

|

1. |

Russia |

82,364 |

Russia |

68,412 |

|

2. |

Ukraine |

35,651 |

Slovakia |

37,841 |

|

3. |

Slovakia |

31,854 |

Ukraine |

36,475 |

|

4. |

United Arab Emirates |

19,513 |

United Arab Emirates |

18,360 |

|

5. |

Czech Republic |

19,182 |

Czech Republic |

16,802 |

|

6. |

Saudi Arabia |

14,082 |

Belarus |

11,526 |

|

7. |

Belarus |

13,877 |

Netherlands |

11,006 |

|

8. |

Kazakhstan |

10,534 |

Saudi Arabia |

9,798 |

|

9. |

Netherlands |

9,163 |

Turkey |

8,608 |

|

10. |

Romania |

8,854 |

Romania |

8,041 |

|

11. |

Other |

104,545 |

Other |

104,126 |

|

|

Total |

349,619 |

Total |

330,995 |

SALES BY PRODUCT LINES

The table below provides a breakdown of revenue by product lines for Q1 2011 and Q1 2010:

|

|

Q1 2011 |

Q1 2010 |

||

|

|

USD thousands |

% of revenues |

USD thousands |

% of revenues |

|

Central processing units (CPUs) |

83,023 |

23.75% |

72,763 |

21.98% |

|

Hard disk drives (HDDs) |

43,361 |

12.40% |

47,912 |

14.48% |

|

Software |

37,933 |

10.85% |

18,408 |

5.56% |

|

PC-mobile (laptops) |

84,656 |

24.21% |

68,231 |

20.61% |

|

Other |

100,646 |

28.79% |

123,681 |

37.37% |

|

Total revenue |

349,619 |

100% |

330,995 |

100% |

The revenue breakdown by product lines confirms the Company’s strategy of a strong move to finished goods, A-branded goods, accessories, multimedia and own brands. This is especially visible in the growing importance of the software and laptop segments to total revenues. Apart from that, the Company is still strong in the components segment and was able to benefit from this on the sales levels. The revenue structure is dominated by laptop segment, which grew by 24.07% y-o-y. Additionally, revenues generated from software almost doubled, while the Company remained strong in the CPU and HDD segments.

- Revenue from sale of CPUs increased by 14.1%, to USD 83,023,000, from USD 72,763,000 in Q1 2010.

- Revenue from sale of HDD decreased by 9.50%, to USD 43,361,000, from USD 47,912,000 in Q1 2010.

- Revenue from sale of software increased by 106.07%, to USD 37,933,000, from USD 18,408,000 in Q1 2010. This was mostly due to a strong, 134.05% increase in unit sales of software from different manufacturers, including Microsoft, and antivirus and virtualization solutions.

- In Q1 2011, revenue from sale of PC-mobile (laptops) increased by 24.07%, to USD 84,656,000, from USD 68,231,000 in Q1 2010, and again became the number one contributor to the Group’s revenues. As this was expected, and because of the convergence in the IT market towards finished products, the Group was fast enough to adapt early to the new environment and managed to increase its market share in the PC laptop segment. It is expected that this segment will drive the Company’s revenues also in future periods.

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail: d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

Iwona Mojsiuszko, M+G

Tel. +48 22 625 71 40

Tel. +48 501 183 386

E-mail: iwona.mojsiuszko@mplusg.com.pl

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide.

The Group distributes products of many vendors and manufactures and sells private-label products: Prestigio (external storage, leather-coated USB accessories, GPS devices, etc.) and Canyon (MP3 players, networking products and other peripheral devices).

ASBIS has subsidiaries in 26 countries, more than 1,000 employees and 32,000 customers.

The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, visit also investor.asbis.com