ASBIS Group in Q3 2013: record sales of own brands result in increased gross profit margins and better profitability at all levels

Limassol, Cyprus, November 7th, 2013 — ASBISc Enterprises Plc, a leading distributor of IT products in emerging markets of Europe, the Middle East and Africa, reported a successful Q3 2013. During this period, the company focused on improving its gross profit margins and profitability by refining its product portfolio and increasing its own brand sales, which hit a new record with USD 128m. Thus while in Q3 2013 revenues grew by 1.1%, to USD 438.24m, the gross profit margin grew by 36.1%, to 6.4%, from 4.7% in Q3 2012, leading the company’s profitability to grow on all levels. Gross profit increased by 37.59%, to USD 28.08m, from USD 20.41m in Q3 2012. EBITDA grew by 152.22%, to USD 14.61m, from USD 5.79m, over the same period, and NPAT grew by 49.84%, to USD 3.04m in Q3 2013, from USD 2.03m in Q3 2012. At the same time, the company has significantly improved cash flow management, despite investments in new high-margin product lines.

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “We have continued to introduce changes in our product portfolio. Thus, while revenues were comparable to those from Q3 2012, our business during this period was completely different. We had less sales from traditional components (like CPUs and HDDs) and laptops, focussing our efforts on increasing sales in the booming high-margin segments of tablets and smartphones, especially on own brands. We are pleased with the results of our work, which allowed us to significantly increase our overall gross profit margin, profit from operations, and, most importantly, NPAT. Even though revenues are expected to pick up again during the last quarter of the year, in the past quarter we strove for better profitability and improved cash flow. We consider the results for Q3 satisfactory.”

Kostevitch continued: “What is very important for us, we continued to improve our cash flows while still supporting growth in results. We achieved 50% higher profit on nearly the same revenue as a year before, while cash flow from operating activities increased by about USD 61m for the first nine months of 2013, to USD 6m inflows this year, compared to USD 55m outflows in the same period of 2012. This means we have improved working capital management, and we expect to benefit from that also in the future, delivering even more robust results and maximizing shareholder value. Further improvement in margins, profitability and cash flow will be our main focus in Q4 2013 and in 2014.”

FINANCIAL RESULTS IN Q3 2013 AND Q3 2012 (USD ’000)

|

Q3 2013 |

Q3 2012 | Change | |

| Revenues | 438,243 | 433,543 | +1.08% |

| Gross profit | 28,081 | 20,409 | +37.59% |

| Gross profit margin | 6.41% | 4.71% | +36.11% |

| Administrative expenses | 7,322 | 5,700 | +28.45% |

| Selling expenses | 13,360 | 9,602 | +39.14% |

| Operating profit | 7,399 | 5,107 | +44.89% |

| EBITDA | 14,608 | 5,792 | +152.22% |

| Net profit | 3,042 | 2,030 | +49.84% |

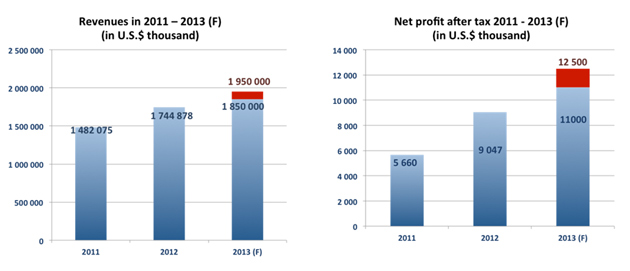

FINANCIAL FORECAST FOR 2013

For 2013, ASBIS forecasts revenues between USD 1.85 billion and USD 1.95 billion and NPAT from USD 11.0 million to USD 12.5 million.

DETAILED INFORMATION ON SALES PROFILE

The most important development of Q3 2013 was a strong increase in sales of own brands and their contribution to total revenues.

- In Q3 2013 revenues from own brands grew by 215.43%, to a new historical record of USD 128.09m, compared to USD 40.58m in Q3 2012. Own brands’ contribution to total revenues was 29.23%, compared to 9.37% in Q3 2012.

- The company also significantly increased sales in the booming segments of tablets and smartphones:

- In Q3 2013 revenue from sale of tablets (both own brands and third-party) increased by 168.27%, to USD 86.30m, from USD 32.18m in the corresponding period of 2012. This was mostly due to significantly higher unit sales.

- In Q3 2013 revenue from sale of smartphones increased by 101.54%, to USD 85.22m, from USD 42.28m in the corresponding period of 2012. This was mostly due to significantly higher unit sales.

REVENUE BREAKDOWN BY REGIONS IN Q3 2013 AND Q3 2012 (USD ’000):

| Region | Q3 2013 | Q3 2012 | Change % |

|

Former Soviet Union |

173,282 | 180,546 | -4.02% |

|

Central & Eastern Europe and Baltic States |

155,726 | 152,510 | +2.11% |

| Middle East and Africa | 55,065 | 56,467 | -2.48% |

| Western Europe | 42,570 | 28,481 | +49.47% |

| Other | 11,601 | 15,539 | -25.34% |

| Total | 438,243 | 433,543 | +1.08% |

Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc, commented: “The broad geographic coverage of our operations, our strong product portfolio and investments in own brands development have allowed us to benefit from positive changes in certain markets. In our opinion, the fact that the CEE region’s contribution to total revenues grew significantly year-on-year and that Western Europe’s contribution is growing on the back of our own brands sales, increases the company’s strength, as our dependence on one big region decreases. Therefore, we intend to support this trend in the future.”

REVENUE BREAKDOWN IN Q3 2013 AND Q3 2012 – TOP 10 COUNTRIES (USD ’000)

| Q3 2013 | Q3 2012 | |||

| Country | Sales | Country | Sales | |

| 1. | Russia | 96,557 | Russia | 94,747 |

| 2. | Slovakia | 39,104 | Ukraine | 47,975 |

| 3. | Ukraine | 38,902 | Slovakia | 36,219 |

| 4. | United Arab Emirates | 32,583 | Bulgaria | 32,517 |

| 5. | Bulgaria | 25,694 | United Arab Emirates | 31,566 |

| 6. | Czech Republic | 19,326 | Czech Republic | 17,832 |

| 7. | Belarus | 19,067 | Kazakhstan | 17,476 |

| 8. | Kazakhstan | 16,303 | Belarus | 16,971 |

| 9. | Poland | 13,923 | Lithuania | 13,544 |

| 10. | United Kingdom | 13,083 | Hungary | 12,033 |

| 11. | Other | 123,702 | Other | 112,664 |

| TOTAL | 438,243 | TOTAL | 433,543 | |

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021

E-mail d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail costas@asbis.com

Iwona Mojsiuszko, M+G

Tel. +48 22 625 71 40

Tel. +48 501 183 386

E-mail iwona.mojsiuszko@mplusg.com.pl

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide. The Group distributes products of many vendors, manufactures and sells private-label products: Prestigio (smartphones, tablet PCs, external storage, leather-coated USB accessories, GPS devices, etc.) and Canyon (MP3 players, networking products and other peripheral devices). ASBIS has subsidiaries in 26 countries, more than 1,500 employees and 32,000 customers. The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, also visit the company’s website at www.asbis.com or investor.asbis.com