ASBIS in Q4 2011: Financial Forecasts Surpassed Thanks to Strong Growth in Gross and Net Profit

Limassol, Cyprus, February 28, 2012 — In Q4 2011 gross profit rose 34.94% to USD 29.428 million and Net profit of USD 8.276 million showed impressive 332.35% growth

ASBISc Enterprises Plc, a leading distributor of IT products in emerging markets of Europe, the Middle East and Africa, posted revenues of USD 470 million for the fourth quarter of 2011, 1.45% lower than in Q4 2010. In the same time the Company significantly increased its profitability, by significantly increasing gross profit margins, through its upgraded product portfolio, effective hedging strategy and increased ASP of the HDD segment following the shortage created by the floods in Thailand. As a result gross profit for Q4 2011 grew by 34.94% to USD 29.428 million, compared to USD 21.809 million in Q4 2010, and net profit grew impressively by 332.35% to USD 8.276 million, compared to USD 1.914 million in Q4 2010.

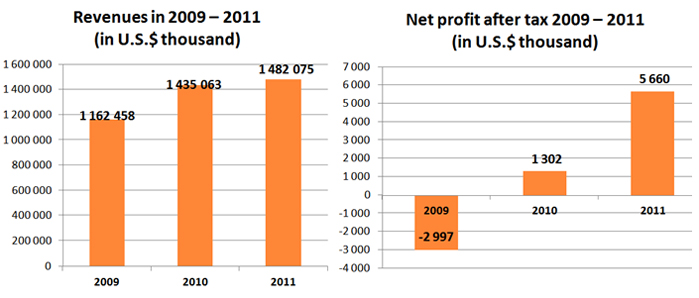

For the twelve months of 2011 ASBISc revenues grew by 3.28% to USD 1.482 billion, from USD 1.435 billion in 2010. Net profit after tax grew to USD 5.660 million, from USD 1.302 million, thereby significantly exceeding the Company’s financial forecasts.

“We promised that in 2011 we would focus on increasing profitability through an upgraded product portfolio and effective currency hedging,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “Things may have looked unfavourable after Q2 when unexpected events hit our results. However, having in mind the work we had done on upgrading the product portfolio and increasing gross profit margins, we were confident that it would bring measurable benefits and deliver profit at the forecast level. In Q4 2011 the results of our hard work were already visible, as the gross profit margin grew to 6.26%, compared to 4.57% in Q4 2010, and EBITDA more than doubled to USD 11.465 million. This was possible on one hand due to better margins on the HDD segment, more selective sales in the laptop segment and a strong increase in own brands sales, which grew to about 7% of our total revenues. On the other hand we restructured our expenses: administrative expenses decreased and selling expenses grew significantly slower than gross profit. If we add that our hedging strategy worked well for another consecutive quarter, growth in profits was the natural result. Our NPAT forecast of between USD 3 million and USD 4.5 million was exceeded, as we delivered USD 5.66 million, or 25.78% higher than the upper range of the published forecast. If not for the unexpected factors hitting our results in Q2 2011, our results could have been even better. Therefore, we are confident that ASBISc can generate greater profit for its shareholders in 2012 despite the highly volatile environment we must operate in during 2012. We will release an official forecast of results for this year shortly.”

Financial results in 2011 and 2010 (in USD thousand)

|

|

Q4 2011 |

Q4 2010 |

Change |

Q1-4 2011 |

Q1-4 2010 |

Change |

|

Revenues |

470,157 |

477,069 |

-1.45% |

1,482,057 |

1,435,063 |

+3.28% |

|

Gross profit before currency movements |

29,740 |

23,507 |

+26.51% |

81,126 |

70,103 |

+15.72% |

|

Gross profit after currency movements |

29,428 |

21,809 |

+34.94% |

81,250 |

66,360 |

+22.44% |

|

Gross profit margin |

6.26% |

4.57% |

+36.92% |

5.48% |

4.62% |

+18.61% |

|

Administrative expenses |

(6,281) |

(6,435) |

-2.4% |

(25,168) |

(23,466) |

+7.2% |

|

Selling expenses |

(12,501) |

(10,843) |

+15.28% |

(40,421) |

(33,464) |

+20.79% |

|

Operating profit |

10,647 |

4,530 |

+135.03% |

15,660 |

9,429 |

+66.09% |

|

EBITDA |

11,465 |

5,328 |

+115.18% |

18,748 |

12,439 |

+50.72 |

|

Net profit |

8,276 |

1,914 |

+332.35% |

5,660 |

1,302 |

+334.72 |

Exceeding the financial forecast for 2011

For 2011 ASBIS forecast from USD 1.6 billion to USD 1.65 billion of revenues and from USD 3.0 million to USD 4.5 million of net profit. Through four quarters of 2011, the revenues forecast was delivered in 92.62% and the net profit forecast was exceeded by 25.78% compared to the upper range of the forecast and 88.67% compared to the lower range of the forecast.

“We focused on profitability and did not go for low-margin revenue,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “If we add temporary limited business in Belarus that only in Q4 of 2010 gave us USD 25.6 million of sales, it is clearly visible why revenues were slightly lower than the forecast. We are still able to increase our sales in 2012. This means that with better quality of sales we are able to be even more profitable.”

Detailed information on sales profile

In Q4 2011 revenues derived from F.S.U. countries dropped by 5.61% as a result of the Company’s effort to focus on high-margin sales. However, for the twelve months of 2011 sales in F.S.U. countries confirmed the growing trend, up 4.51% from 2010. Revenues in CEE were stable in Q4 but grew by 5.56% in the twelve months of 2011, while revenues in the Middle East and Africa remained almost unchanged in Q4 2011 and for the twelve months of 2011 compared to the corresponding periods of 2010. The stable sales base allowed the Company to focus on rebuilding its product portfolio and sales strategy to focus more on profitability, and results of this step were clearly visible in the income statement.

“Geographical diversification of sales allowed us to increase profitability despite the fact that overall revenues remained almost unchanged in 2011, as we were able to conduct more selective sales in particular markets and move stock between them,” commented Siarhei Kostevitch, CEO and Chairman of ASBISc Enterprises Plc. “Revenues derived in the three biggest markets – Russia, Ukraine and Slovakia – remained almost unchanged in Q4 2011 compared to Q4 2010: +7.81% growth in sales in Slovakia offset a 2.45% and 4.46% drop in sales in Russia and Ukraine respectively. In the same time, revenues derived from some other countries grew significantly, for example in the United Arab Emirates (+37.10%), the Czech Republic (+8.74%), Kazakhstan (+66.13%), Bulgaria (+16.61%) and Romania (+21%). This allows us to be optimistic about growth in 2012.”

Revenue breakdown by regions in Q4 2011 and Q4 2010 (in USD thousand):

|

Region |

Q4 2011 |

Q4 2010 |

|

Former Soviet Union |

202,318 |

214,334 |

|

Central and Eastern Europe |

166,903 |

166,700 |

|

Middle East and Africa |

56,898 |

55,700 |

|

Western Europe |

31,029 |

26,980 |

|

Other |

13,008 |

13,355 |

|

Total |

470,157 |

477,069 |

Revenue breakdown in Q4 2011 and Q4 2010 – top 10 countries (in USD thousand)

|

|

Q4 2011 |

Q4 2010 |

||

|

|

Country |

Sales |

Country |

Sales |

|

1. |

Russia |

117,307 |

Russia |

120,252 |

|

2. |

Slovakia |

58,637 |

Slovakia |

54,387 |

|

3. |

Ukraine |

49,587 |

Ukraine |

51,904 |

|

4. |

United Arab Emirates |

29,000 |

Czech Republic |

26,011 |

|

5. |

Czech Republic |

28,285 |

Belarus |

25,593 |

|

6. |

Kazakhstan |

24,260 |

United Arab Emirates |

21,153 |

|

7. |

Bulgaria |

14,038 |

Saudi Arabia |

15,407 |

|

8. |

Romania |

12,662 |

Kazakhstan |

14,603 |

|

9. |

Saudi Arabia |

10,681 |

Bulgaria |

12,039 |

|

10. |

Croatia |

9,103 |

Romania |

10,464 |

|

11. |

Other |

116,597 |

Other |

125,257 |

|

Total revenue |

470,157 |

Total revenue |

477,069 |

|

For additional information, please contact:

Daniel Kordel, ASBISc Enterprises PLC, Investor Relations

Tel. +357 99 633 793

Tel. +48 509 020 021 E-mail: d.kordel@asbis.com

Costas Tziamalis, ASBISc Enterprises PLC, Investor Relations

Tel. +357 25 857 000

E-mail: costas@asbis.com

Iwona Mojsiuszko, M+G

Tel. +48 22 625 71 40,

Tel. +48 501 183 386

E-mail: iwona.mojsiuszko@mplusg.com.pl

ASBISc Enterprises Plc is based in Cyprus and specializes in the distribution of computer hardware and software, mobile solutions, IT components and peripherals, and a wide range of IT products and digital equipment. Established in 1990, the Company has a presence in Central and Eastern Europe, the Baltic States, the former Soviet Union, the Middle East, and North Africa, selling to 75 countries worldwide.

The Group distributes products of many vendors and manufactures and sells private-label products: Prestigio (external storage, leather-coated USB accessories, GPS devices, etc.) and Canyon (MP3 players, networking products and other peripheral devices).

ASBIS has subsidiaries in 26 countries, more than 1,000 employees and 32,000 customers.

The Company’s stock has been listed on the Warsaw Stock Exchange since October 2007 under the ticker symbol “ASB” (ASBIS).

For more information, visit also the company's website at www.asbis.com or investor.asbis.com